VT Markets

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD

-

🛠 PlatformsMT4, MT5, TradingView, TradingCentral

-

⇔ Spread

GBPUSD: 0.4 pips EURUSD: 0.4 pips GBPEUR: 1.4 pips -

# Assets40+

-

🪙 Minimum Deposit$200

-

🫴 Bonus Offer50% Welcome Bonus

Our Opinion On VT Markets

Our first-hand experience using VT Markets has generally been positive – the suite of platforms impresses with MT4, MT5 and TradingView, account opening is fast, and the Trading Central insights are useful for trading ideas.

Considering the negatives, our tests show that trading fees in the STP account are on the high side, while the customer service, education and copy trading app trail the best forex brokers.

Verdict: VT Markets is a good all-round forex broker with potential, but it doesn’t rival industry leaders yet.

Summary

- Instruments: 1000+ CFDs including 40+ currency pairs, stocks, indices, commodities, ETFs, bonds

- Live Accounts: Standard STP, Raw ECN

- Platform & Apps: MT4, MT5, TradingView, VT Markets App

- Deposit Options: Wire transfer, credit/debit card, Perfect Money, Google Pay, FasaPay, crypto

- Demo Account: Yes

Pros & Cons

- Convenient account funding with multiple payment methods and no fees

- Powerful charting and technical analysis package from TradingView

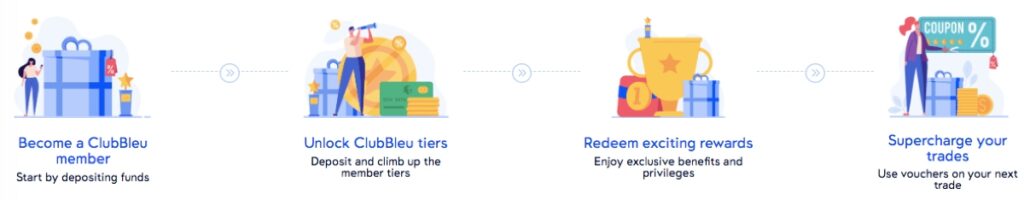

- ‘ClubBleu’ program rewards active traders with withdrawable credit

- Straightforward registration process that takes <5 minutes

- Excellent platform integration with MT4 and MT5

- Authorized by a tier-one regulator - the ASIC

- Unsatisfactory support with slow response times and limited contact methods

- Trading fees trail the cheapest brokers in the Standard account

- The global entity is overseen by a high-risk regulator - the SVGFSA

- VTrade copy trading app has a limited pool of strategy providers

- Average investment offering including around 40 currency pairs

- Limited education to support new traders

Is VT Markets Regulated?

We see VT Markets as having a good score in this category since one of the broker’s entities has obtained a coveted license from the Australian Securities and Investments Commission (ASIC). This is one of the world’s most respected bodies, and its oversight speaks to the firm’s high standards.

Any traders outside ASIC’s jurisdiction will not be protected by as rigorous regulatory oversight. Traders will either be covered by the Financial Sector Conduct Authority (FSCA) of South Africa, which is still a respected regulator, or the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), which we consider high-risk.

The good news is that these branches still segregate clients’ funds from business money and implement negative balance protection, which along with a decent haul of industry awards, boosts brand trust and credibility for us.

The VT Markets entities and regulators are:

- VT Global Pty Ltd: Regulated by the Australian Securities & Investments Commission (ASIC), license number 516246

- VT Markets (Pty) Ltd: Regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, license number 50865

- VT Markets LLC: Registered with Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), registration number 673 LLC

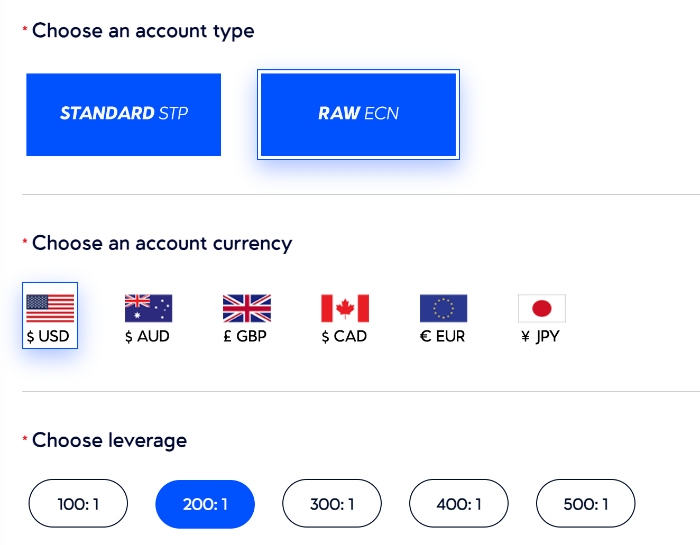

Forex Accounts

VT Markets offers two live accounts to retail investors, both with an accessible minimum deposit of $100.

We are happy with the different execution models offered, as the STP and ECN accounts suit varying strategies while being easy to get started with. The STP account is best for beginners while the ECN solution is designed for experienced traders.

Similar to Pepperstone and other brokers, the accounts are divided into a spread-only account and an account with raw spreads and commission:

- Standard STP: Low spreads, no commission fees, consistent pricing transparency from liquidity partners via VT Markets oneZero MT4 Bridge.

- Raw ECN: Interbank spreads with no mark-up, $6 commission fee per lot, custom-made fibre optic network connection

Additionally, Islamic traders are catered for with a swap-free account. Both original account types are accessible with no swaps, and execution conditions mirrored.

Importantly, we had no issues signing up for a trading account with VT Markets. The process was straightforward and took us four minutes.

Trading Fees

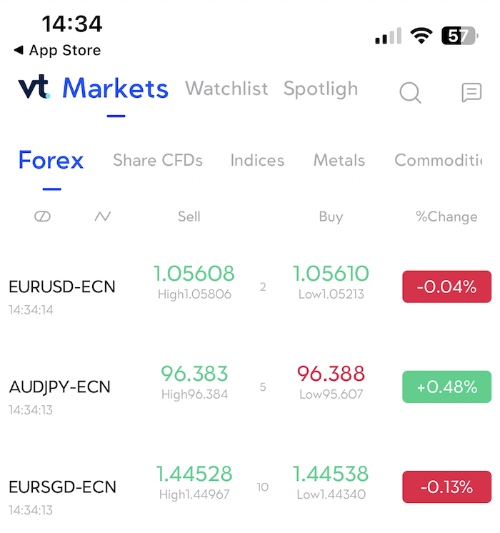

After scrutinizing VT Markets’ pricing structure, we have found that trading fees are not the cheapest, but on a level with many forex brokers we have reviewed.

While testing the ECN account, we were offered a 0.4 pip spread on the EUR/USD and 0.6 pips on the GBP/USD. As a comparison, low-cost broker Pepperstone offered us 0.1 pips and 0.7 pips on the same currency pairs, with an equal commission of $6.

Fees on the commission-free Standard STP account came in on the high side during our tests. We got spreads from 1.3 pips on the EUR/USD and 1.8 pips on the GBP/USD. Again, Pepperstone comes in cheaper, with spreads averaging 1.1 pips and 1.7 pips on the same pips.

One bonus for high-volume traders is VT Markets’ cashback program, with some excellent rewards – up to $3 per lot traded.

Non-Trading Fees

VT Markets scores better when it comes to non-trading fees. The broker keeps non-trading charges to a minimum – there are no deposit and withdrawal fees nor inactivity penalties, while industry-standard swap rates apply for positions held overnight.

Payment Methods

Our experience depositing to a VT Markets trading account has been positive; we like that no payment methods incur a fee, and there are good choices of e-wallets, wire transfers, credit/debit cards, and even cryptocurrency.

It is also great to see mainstream e-wallets like Apple Pay and Google Pay, as this speaks to the firm’s commitment to offering the latest convenient funding solutions.

We especially like that the broker covers the merchant fees for e-wallets and alternative payment methods, making funding your account affordable.

It is worth mentioning that all payment methods have their own processing times but we found that the majority offer instant funding – beneficial for forex traders who want to get started quickly.

Tip: Upload the requested identity documents at the sign-up stage. You can’t withdraw until your ID has been verified and we found this can take up to 12 hours.

Forex Assets

We favor forex brokers that provide a good choice of major, minor, and exotics as they give their traders the best range of opportunities and the chance to hedge against volatility.

With just 40+ currency pairs available, VT Markets drops marks here. This is on the low end of what we consider acceptable for a top-rate forex broker, and although it is in line with some leading firms like eToro, it is some way behind competitors like IC Markets with 60+.

Crucially though, after logging in and using the platform, we found that VT Markets provides opportunities on the most popular currency pairs, including:

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

Most retail forex traders appreciate the chance to look beyond their chosen currency pairs and take advantage of opportunities in other asset classes, so we see a broker’s non-forex asset range as an important factor in our reviews.

VT Markets offers a modest list of 1000+ CFDs including a large range of global stocks and ETFs. As a comparison, brokers like IG offer north of 17,000 instruments.

We provide the full breakdown of markets available when trading with VT Markets below:

- Indices: 15+ stock indices including the FTSE, Dow Jones, and DAX

- ETFs: 51 exchange-traded funds across several sectors including technology and energy

- Shares: 800+ US, Asian, and European stock CFDs such as Tesla, Apple, and Google

- Commodities: 4 spot energies, 3 precious metals, and 7 soft commodities including gold, coffee, and crude oil

- Bonds: 7 bond CFDs such as the UK Long Gilt Futures, US 10-year Treasury Bond Futures, and Euro-Bund Futures

What We’d Like To See

One key asset class we think is really missing is cryptocurrencies. VT Markets could strengthen its appeal by offering opportunities on digital assets.

Execution

We are big fans of VT Markets’ hybrid ECN and STP execution model. Both offer no dealing desk intervention, with orders filled electronically and having the choice of two covers varied traders’ strategies and preferences.

ECN execution ensures high-speed transactions, with the security of a flat commission fee and lower spreads. STP execution may be more suitable for forex traders looking for zero commissions, plus access to the interbank market, though execution times can be less consistent.

Leverage

While VT Markets’ ASIC-regulated branch is limited to 1:30 leverage, our research shows the broker offers much higher leverage of up to 1:500 through its global entities.

While we usually urge inexperienced traders to steer clear of high leverage since it can lead to crippling losses, we know that experienced traders who are confident in risk management can get great value from higher leverage.

We also welcome the fact that VT Markets offers flexible leverage, meaning you don’t have to trade with large levels if they don’t suit your strategy.

While testing the VT Markets’ MT5 platform, we learned you get a margin call if your margin level drops below 80% and a stop out when it reaches 50%.

Platforms & Apps

We have been thoroughly impressed with the trading platform options offered by VT Markets. With the popular MT4 and MT5 platforms, TradingView and an app, we feel assured there is something suitable for traders of all experience levels and strategies.

In our opinion, TradingView is the best option for beginners, given its intuitive interface and flexible charting. Experienced forex traders may be more comfortable on MT5 given its dependability and order placement capabilities.

MT4 & MT5

MT4 and MT5 are among the most-used forex platforms in the industry. They offer a sophisticated trading experience, with PC download, web trading, and mobile app integration.

Though both are suitable for forex trading and offer the esteemed expert advisor (EA) automated trading functionality, we prefer using MT5 as it offers more tools and integrated functions, including extra order types and timeframes.

We like the risk management tools including stop-loss and take-profit orders on both platforms, but where MT5 really stands out for us is the multi-thread strategy back-testing capabilities, with an integrated economic calendar and news stream.

How To Make A Forex Trade

We have placed forex trades on MetaTrader many times, and find it quick and seamless to place orders in several ways, including:

- Find a currency pair to trade from the ‘Market Watch’ window on the left

- Right-click on the currency pair and select ‘New Order’

- Input your trade parameters to the order ticket, including order type, trade volume, and stop-loss or take-profit prices

- Confirm the order by choosing ‘Buy’ or ‘Sell’

TradingView

We really enjoy TradingView’s sleek and modern design and find it a much smoother approach to trading forex vs MetaTrader 4 & 5, especially for new traders.

For those looking for advanced charting, TradingView certainly gets our vote too. Offering 16 chart types, we rate the choice of traditional charts such as line, area, and baseline, as well as Heikin Ashi, Renko, and Kagi.

The software also offers 100+ integrated technical indicators, including RSI and MACD, and 50 drawing tools such as Fib Retracements and Gann charts for accurate price pinpointing.

For us, a particular stand out is the fact that such a comprehensive charting package works smoothly via web browsers with no need for additional downloads. We also didn’t experience any glitches or loading issues during testing.

A final feature we find value in is the community forum, which provides access to trading ideas, plus educational content from peer traders and pro analysts.

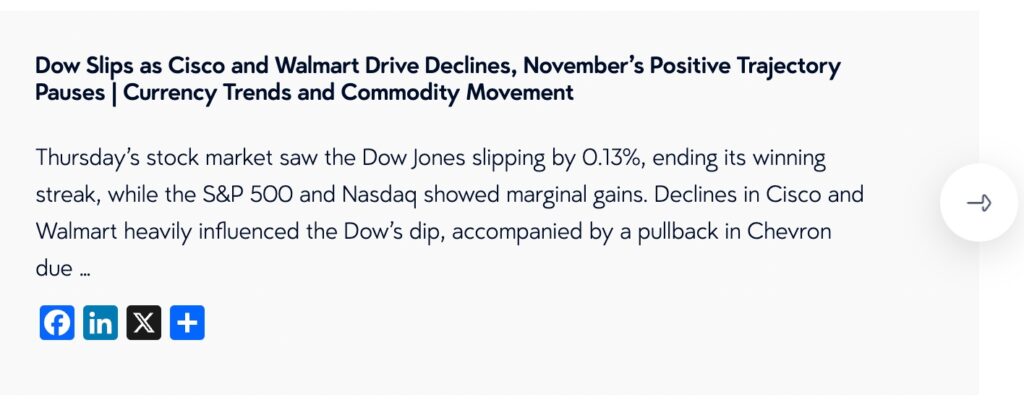

VT Markets App

We enjoy using VT Markets’ proprietary mobile platform to access market news and insights while on the go. This information is updated throughout the day, making it a useful referral point to help with trade execution and ideas.

Mobile traders don’t sacrifice too much on functionality either – the app offers interactive charting and is available in multiple languages with customer support.

Forex Tools

We see VT Markets’ range of forex trading tools as one of its biggest strengths, with a selection of additional features from copy trading to Trading Central insights that will satisfy new and experienced traders alike.

Trading Central

VT Markets offers Trading Central, an insights and analytics service that can be integrated directly within the MT4 platform.

We get a lot from this tool, particularly for trading ideas and identifying entry and exit points. We also find the economic insights really useful, demonstrating visually how events may impact FX pairs with volatility and direction projections.

Our only criticism is that access is restricted to those depositing over $500 only, as this may put this feature out of reach of some budget traders.

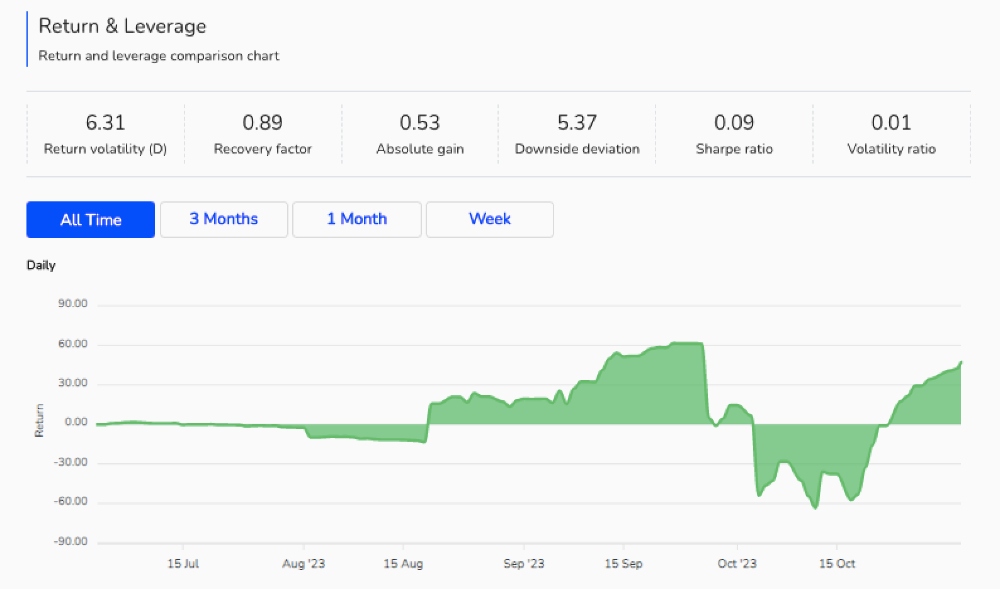

VTrade

VT Markets offers a copy trading service, VTrade, which allows traders to track and mirror the positions of more experienced forex traders in real-time. We rate social trading services that allow you to set your own investment amounts and risk tolerance.

Although we note the solution is not as extensive as that offered by eToro, it does have a roster of 100+ signal providers, and we are pleased to see detailed performance history and statistics to help traders pick who to copy.

What We’d Like To See

We would like to see a wider pool of strategy providers to choose from. This would help VT Markets rival best-in-class copy trading brokers.

MAM and PAMM solutions are also available, in partnership with MetaFX. These services enable professionals to operate an unlimited number of trading accounts, with all trading styles accepted and full access to order types including pending stop-loss, and take-profit.

VPS

We are happy to see the provision of free VPS, as this can be a cornerstone of automated strategies used by forex day traders.

The service is available on MT4 accounts, and though it would be nice to have a similar service on other platforms, MetaTrader’s Expert Advisors are probably the most popular trading robots for these types of strategies, so this should give algorithmic traders the support they need.

Forex Research

After weeks of first-hand testing, we have been disappointed in the forex research and analytics available. There is simply very little there, besides an admittedly useful ‘Picks of the Day Analysis’ and a few daily bulletins.

This leaves the forex broker far behind options like City Index which offers extensive research tools.

Forex Education

After thoroughly investigating the training materials provided, we can say that VT Markets’ education is light. There is content organized in a ‘blog’ section that includes none of the video tutorials or podcasts offered by rivals. Instead, there is text material organised by level (beginner or intermediate) with articles and supporting diagrams as well as a keyword glossary.

There are also basic guides to learning forex and using MT4 plus Trading Central under the ‘Education’ section. These are reasonably useful, but very text-heavy and not particularly engaging.

In our opinion, there simply isn’t enough high-quality materials for beginners and falls short of competitors. If education is important to you, we recommend one of the alternatives below.

Alternative Brokers for US

Demo Account

After testing VT Markets’ demo account with $100,000 in virtual funds, we are pleased with the real-time pricing, live market conditions and opportunity to test the MetaTrader platforms.

This means that traders can truly get a thorough understanding of the forex broker’s services before opening a live account.

Tip: Although paper profiles close after 90 days, you can open multiple accounts for strategy testing in parallel with your live account.

Bonus Offers

VT Markets stands out for its variety of welcome bonuses and financial incentives for new and existing traders.

Though we don’t recommend choosing a brokerage based on bonuses, free credit to practice trading can be useful, especially when starting out.

The live promotions available to us during our VT Markets review included:

- Deposit bonus (20% or 50%)

- Loyalty program (ClubBleu)

- Other offers (contests, cashback, signals and tools)

We especially like the ‘ClubBleu’ loyalty program, since this gives traders benefits and rewards that scale up as they continue trading with VT Markets. And unlike many similar schemes, the broker allows users to convert points they earn into withdrawable cash.

We did discover one downside, however, which is that it doesn’t count trades made on the mobile app.

Trading Restrictions

We did not come across any forex trading restrictions, meaning retail traders are welcome to use various strategies including hedging, scalping, or news trading.

Customer Service

We have been disappointed with VT Market’s customer support, finding it to be glitchy and unresponsive during our various tests. This is a significant downside for us as we consider customer service an indicator of a broker’s professionalism.

We were unable to launch the chat function on several occasions, with site glitches. We also tested the chat via a mobile browser and were frustrated with the chatbot integration. In the end, we were unable to solve our query, despite several attempts to speak to a human agent.

There are a few alternative contact options. You can reach service agents via the live chat (when it works), by email (info@vtmarkets.com), or by requesting a call back.

Company Details

VT Markets was founded in 2015, offering online trading services to clients in 160+ countries.

Today the broker has over 200,000 registered client accounts, executing 4 million trades per month with $200 billion in trade volume.

The company has received several industry awards, which is a good sign that its strengths have also been recognized by other users. These include the Best Forex Broker Australia 2022 and Best Forex Mobile App 2022.

Trading Hours

The forex market is open 24 hours per day Monday to Friday. VT Markets adheres to these timings, offering trading on all forex pairs from Monday to Friday 00:01 to 25:58.

Helpfully, an integrated Trading Central economic calendar is provided. We particularly appreciate the ‘importance’ rankings, which help to determine events and activities that may cause significant volatility.

Who Is VT Markets Best For?

Based on our first-hand experience using the platform, we believe VT Markets is best for active forex traders seeking a broker with reliable MetaTrader software, easy account opening, and the added benefit of a loyalty program with cashback rewards.

FAQ

Is VT Markets Legit Or A Scam?

Based on our time using VT Markets, we are confident it is a legitimate forex broker. We tested its forex products and trading tools and did not come across anything that made us think the brokerage was running a scam.

Can I Trust VT Markets?

We see VT Markets as a trustworthy broker overall, with regulation from ASIC and important account safeguards. The only major issues we have are the broker’s unsatisfactory customer service and weak regulatory oversight through its global branch, which lower its trust score.

Is VT Markets A Regulated Forex Broker?

VT Markets is regulated by three authorities; the Australian Securities & Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA).

We consider the ASIC highly trustworthy, the FSCA trustworthy, and the SVGFSA high-risk with a poor reputation.

Is VT Markets A Good Or Bad Forex Broker?

Our review shows VT Markets is a decent forex broker, although it trails industry leaders when it comes to support, education and regulation.

The choice of STP or ECN accounts is beneficial, the range of high-quality trading software is excellent, and some useful extras boost the trading experience, including Trading Central insights and copy trading.

Is VT Markets Good For Beginners?

Our assessment shows that VT Markets is an average forex broker for beginners. The $100 minimum deposit is not the lowest we have seen and the education is subpar, but we welcome the copy trading service and free demo account.

Does VT Markets Offer Low Forex Trading Fees?

VT Markets is not the cheapest forex broker. Spreads on the ECN and STP accounts trailed low-cost forex brokers during our tests. The broker does score better when it comes to non-trading fees though, with no deposit/withdrawal charges or inactivity penalties.

Does VT Markets Have A Forex App?

Yes, VT Markets has a mobile app, which can be downloaded to iOS and Android devices. We have found the application to work well on smartphone devices, with access to market sentiment data, news, charting, and more.

How Long Do Withdrawals Take At VT Markets?

VT Markets aims to process withdrawal requests within one working day, which is reasonable. Exact transaction times will vary between payment methods.

Can You Make Money Trading Forex With VT Markets?

It is possible to make money trading forex with VT Markets, though we think beginners should spend time in demo mode before investing money. It is also critical to remember that most retail traders lose money, so have a risk management strategy.

Article Sources

VT Markets PTY LTD – ASIC License