Best Forex Brokers With Demo Competitions

Forex brokers with demo competitions offer a risk-free way to practice trading in a competitive environment. Talented investors can earn rewards while developing their trading skills. In this guide, we share our pick of the best forex brokers offering demo competitions, taking into account:

The frequency of demo trading competitions

The fairness of contest terms and conditions

The ease of entering competitions

The availability of prizes for winners

The quality of forex trading conditions

List of Best Forex Brokers With Demo Competitions 2026

Based on our findings, these are the top 5 forex brokers with demo tournaments:

- FXCM: Best Overall Forex Broker With Demo Competitions

- FXOpen: Biggest Cash Prizes

- LiteFinance: Best For Realistic Trading Conditions

- RoboForex: Best For Trading With High Leverage

- CloseOption: Best For Forex Binary Options Contests

| FXCM | FXOpen | LiteFinance | RoboForex | CloseOption | |

|---|---|---|---|---|---|

| Competition Frequency | Monthly | Weekly, Monthly | Monthly | Daily, Weekly, Monthly | Weekly |

| Prizes | Cash | Cash | Trading Credit | Trading Credit | Cash |

| Withdrawable | Yes | Yes | No | No | Yes |

FXCM: Best Overall Forex Broker With Demo Competitions

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, CAD, AUD, ZAR, CHF

-

🛠 PlatformsMT4, eSignal, TradingView

-

⇔ Spread

GBPUSD: 0.5 pips var* EURUSD: 0.2 pips var* GBPEUR: 0.5 pips var* -

# Assets40

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer-

Why We Recommend FXCM

We recommend FXCM because it is a tightly regulated broker that offers forex demo trading contests with cash prizes.

FXCM also provides excellent trading tools and educational resources, making it a great option for aspiring currency traders.

Below we uncover why FXCM is one of our top forex brokers for demo trading competitions.

Pros/Cons of FXCM

Pros

Cash prizes available to winners

We found that FXCM runs demo competitions with real-money prizes available to top-performing traders. The size of the cash pool depends on the tournament, but in the past, has included $500 for 1st place and $250 for 2nd place.

Importantly, we also discovered that prize money can be withdrawn without stipulations. This is a serious benefit of FXCM, as many alternatives that we reviewed place tough restrictions on prize funds.

Practice trading forex with no strategy restrictions

Our research shows that FXCM is one of the best brokers if you want to practice trading on a wide range of currency pairs with no strategy restrictions.

In most of FXCM’s demo trading contests, you can speculate on over 40 currency pairs with automated trading, scalping and hedging systems all permitted.

Excellent educational materials to support new forex traders

FXCM offers some of the best training materials we have seen for beginners, many of which can supplement the demo trading experience.

The regular webinars are useful for finding trading opportunities, while helpfully, trading classroom sessions are saved online so you can watch them any time. We also downloaded and reviewed the forex trading guide, and found it to be a great tool for new investors.

Cons

Tough conditions to win demo trading contests

The victory conditions in the FXCM All Assets Battle will be challenging for many aspiring traders. We found they require substantial capital growth if you want a chance at winning.

In the competition that we entered during our tests, the top three traders posted more than 500% returns – a hard feat for most online traders.

You can win larger prizes at other forex brokers

The standard prize pool for the FXCM All Assets Battle is $2,150. While this is not a bad prize pot, we noted that this is split between the top 10 traders, with positions 4 to 10 receiving just $50.

With an estimated 2000+ traders in each contest, the chances of winning a substantial prize are small, particularly in the demo contests with an equity growth goal.

Why Is FXCM Better Than The Competition?

FXCM is one of the only brokers we have evaluated that offers real cash prizes.

We are also pleased to see that prizes can be withdrawn without restrictions, which is rare based on our experience.

Who Should Choose FXCM?

FXCM is a good option if you want to take part in forex demo tournaments where you can win cash prizes.

With support for sophisticated platforms like MetaTrader 4, TradingView, Trading Station and Capitalise.ai, FXCM is also good for serious investors looking to try advanced charting software and algo trading solutions.

Who Should Avoid FXCM?

FXCM isn’t best if you want frequent forex demo competitions, such as daily or weekly. While it runs contests from time-to-time, there is not always a set schedule.

FXOpen: Biggest Cash Prizes

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR, GBP, AUD, JPY, CHF, HKD, RUB

-

🛠 PlatformsMT4, MT5, TradingView

-

⇔ Spread

GBPUSD: 0.2 EURUSD: 0.2 GBPEUR: 0.2 -

# Assets50+

-

🪙 Minimum Deposit$1

-

🫴 Bonus Offer-

Why We Recommend FXOpen

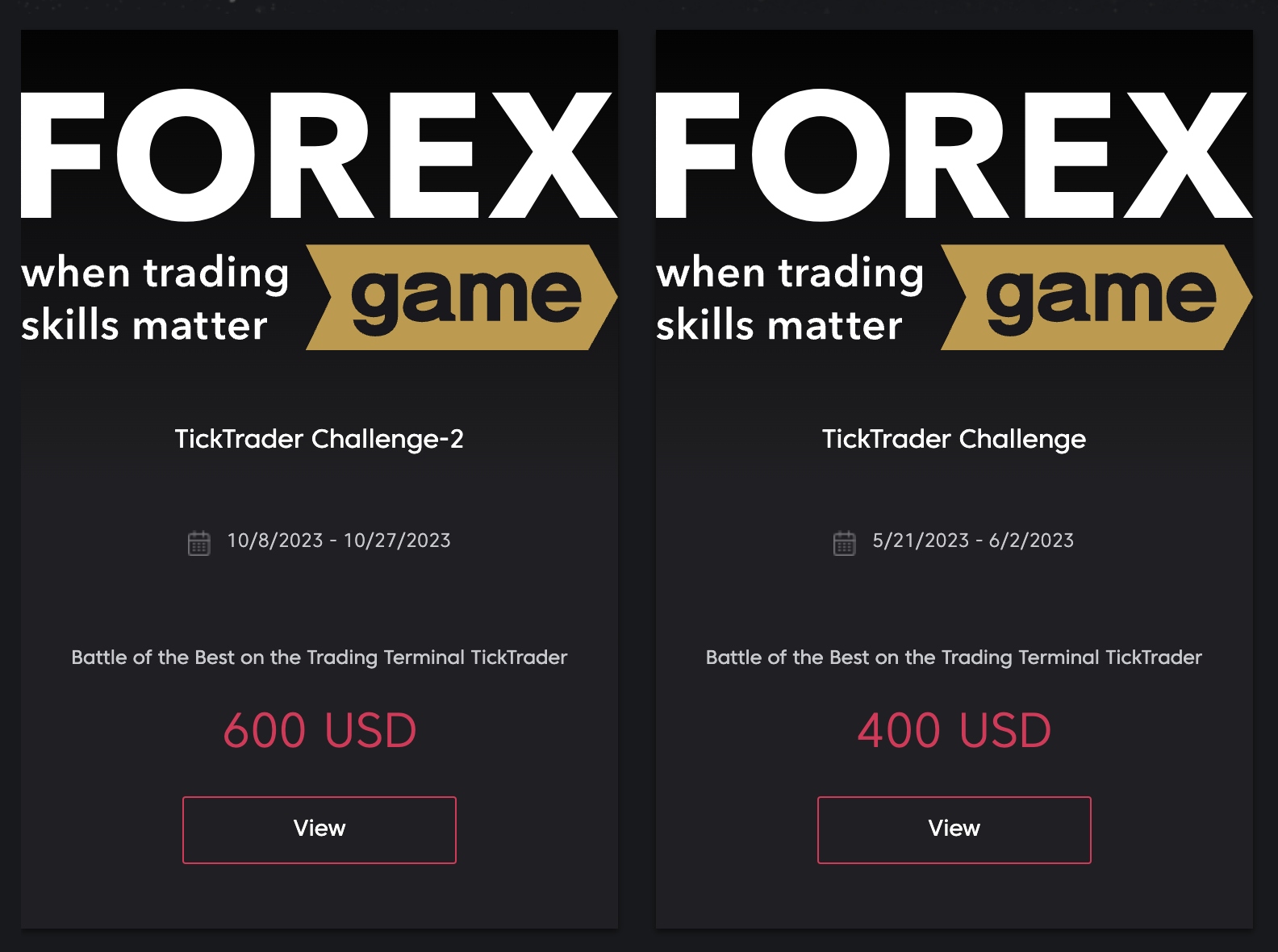

We recommend FXOpen because it offers a variety of demo contests within its proprietary solution, Forex.game.

The broker’s competitions have also paid out over $200,000 to more than 1,500 traders since 2015.

Below we explain why FXOpen is one of our top forex brokers with demo competitions.

Pros/Cons of FXOpen

Pros

Huge cash prizes with up to $50,000 available in the ForexCup

Of the forex brokers we have reviewed, FXOpen is a clear frontrunner in terms of the prize funds it makes available.

Investors taking part in the ForexCup Trading Championship 2023, for example, compete for a $50,000 prize. This is many times more than the prizes you can expect in most forex demo trading contests. The top place goes to the trader who earns the most profit over the year.

Different styles of competition, including platform-specific contests

Unlike many of the brokers with forex demo competitions that we review, FXOpen does not limit its users to a single contest.

Previous tournaments have included a competition specifically on the TickTrader platform, a multi-asset profit-building battle, and a money manager contest for those using PAMM accounts.

This means you have the chance to put your skills to the test across a suite of platforms and in a range of trading areas. We think this will accommodate a broader range of trading styles and systems than the typical demo forex broker.

Cons

Not all forex demo competitions are free to enter

Although the majority of FXOpen’s demo contests are free to participate in, some require a small entry fee of $5. This is a downside given that the majority of forex brokers run competitions with no entry charge.

Having said that, charging a small entrance fee may help FXOpen offer large prize pools.

Tough withdrawal conditions often apply to winnings

We carefully reviewed the terms and conditions of some of FXOpen’s demo contests and found that we may need to trade a certain amount before we can withdraw winnings.

In one, for example, there needed to be at least one transaction per $2 of the prize and a minimum of 5 trades. We may also have had to share the broker’s promotional posts on social media.

Exclusions apply in many forex demo contests

While reviewing the Forex.game rules, we found some strict limitations that may deter skilled traders.

For example, if we earn more than $1000 in prize funds, we are not permitted to participate in the broker’s free demo contests until a $500 deposit is made to an FXOpen live account. This money must also remain in our account for 30 days, or we will be prohibited from participating in demo competitions going forward.

This is very restricting, and we feel will take the fun out of the challenge for talented traders who want to get the most out of forex demo tournaments.

Why Is FXOpen Better Than The Competition?

FXOpen excels when it comes to the size of winnings. With over $200,000 paid out in recent years and some winners taking home up to $50,000, the prize pools are very attractive.

The forex broker also offers a variety of demo contests, and we like that regular challenges specific to certain platforms and markets are held.

Who Should Choose FXOpen?

Our findings show that FXOpen is great for forex traders looking to participate in a variety of challenges, which we think can help newer investors learn various aspects of forex trading.

FXOpen is also great if you want a shot at the biggest prize pools, often with thousands of dollars up for grabs. Not many forex brokers offer the same level of winnings.

Who Should Avoid FXOpen?

Forex traders looking to withdraw profits without restrictions should avoid FXOpen. We found that we would often have to meet tough minimum trade and deposit requirements before we can access winning credit.

LiteFinance: Best For Realistic Trading Conditions

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 0.8 EURUSD: 0.2 GBPEUR: 0.5 -

# Assets55

-

🪙 Minimum Deposit$50

-

🫴 Bonus OfferRebate on payment fees

Why We Recommend LiteFinance

We recommend LiteFinance because it is a beginner-friendly forex broker that offers realistic trading conditions in its demo contests. This helps ensure that forex traders can gain a lot from participating in contests even if they don’t win.

Read on for more details about why we like LiteFinance’s forex demo competitions.

Pros/Cons of LiteFinance

Pros

Contest conditions help provide true-to-life trading conditions

LiteFinance’s rules ensure that investors make realistic trades, and we think this is one of the best ways for newer traders to learn about forex trading in a demo environment before upgrading to a real-money account.

For example, LiteFinance uses a risk-to-profitability ratio to judge its forex demo competitions. We also like the fairness of the points system to measure risk, so users who exceed a certain number of points are automatically excluded from contests. Additionally, we found that trading with excessive leverage costs greatly in risk points.

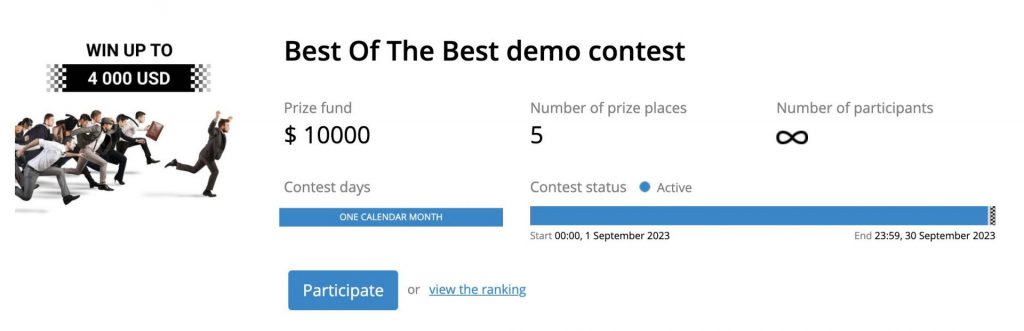

High prizes up to $10,000 for winning traders

Our research shows that LiteFinance has some of the most substantial prize pools. The ‘Best of the Best’ demo contest, for example, offers prizes totalling $10,000 to the top five traders, with the 1st ranked trader eligible for a $4,000 reward.

Social trading system to support new investors

Another strength of LiteFinance in our opinion is its forex social trading. This can be a good way for beginners to interact with, learn from, and copy the trades of experienced forex traders.

During our testing, we found that you can helpfully forecast potential returns depending on the amount we deposit and the chosen timeframe. And while there is no guarantee traders will make money, such systems can be a good way for new investors to learn.

Cons

Cash prizes cannot be withdrawn

Unlike FXCM and FXOpen, LiteFinance does not offer withdrawable cash prizes. Instead, rewards are credited to trading accounts and must be used for transactions in live markets.

Our research also found that credit must be used within 6 months, which is worth bearing in mind for casual investors.

Weak regulatory oversight reduces its trust score

We recommend trading forex with well-regulated brokers, as this will help protect you from scams. LiteFinance is overseen by the reputable Cyprus Securities & Exchange (CySEC) in Europe, however other traders may need to sign up with the offshore, unregulated entity.

This is an important consideration if moving from participating in forex demo competitions to real-money trading.

Why Is LiteFinance Better Than The Competition?

Although it is a little disappointing that prizes cannot be withdrawn directly as cash, we like the risk/profit rules, which help provide realistic investing conditions.

LiteFinance’s demo competitions also offer larger prizes than many alternatives, sometimes up to $10,000.

Who Should Choose LiteFinance?

LiteFinance is a great pick for beginners who want to learn how to speculate on currency pairs by trading in demo competitions that closely mirror real market conditions.

LiteFinance will also appeal to users looking for a competitive real-money trading environment. This is because the broker offers both ECN and Classic accounts with low pricing, so even though the prize money is only available as trading credit, investors can trade forex with confidence if they enjoy success in contests.

Who Should Avoid LiteFinance?

LiteFinance’s demo trading contests are not suitable for investors looking to win real cash prizes. The forex broker only pays out trading credit which can be used in live accounts.

RoboForex: Best For Trading With High Leverage

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD, EUR

-

🛠 PlatformsMT4, MT5

-

⇔ Spread

GBPUSD: 2 EURUSD: 1.4 GBPEUR: 1.6 -

# Assets30+

-

🪙 Minimum Deposit$10

-

🫴 Bonus Offer$30 No Deposit Bonus

Why We Recommend RoboForex

We recommend RoboForex because traders with verified accounts can compete in competitions run through the firm’s ContestFX website.

The broker also offers attractive forex trading conditions with access to the MetaTrader platforms, 40+ currency pairs and tight spreads from 0.0 pips.

Below we reveal why RoboForex ranks as one of the best forex brokers for demo trading competitions.

Pros/Cons of RoboForex

Pros

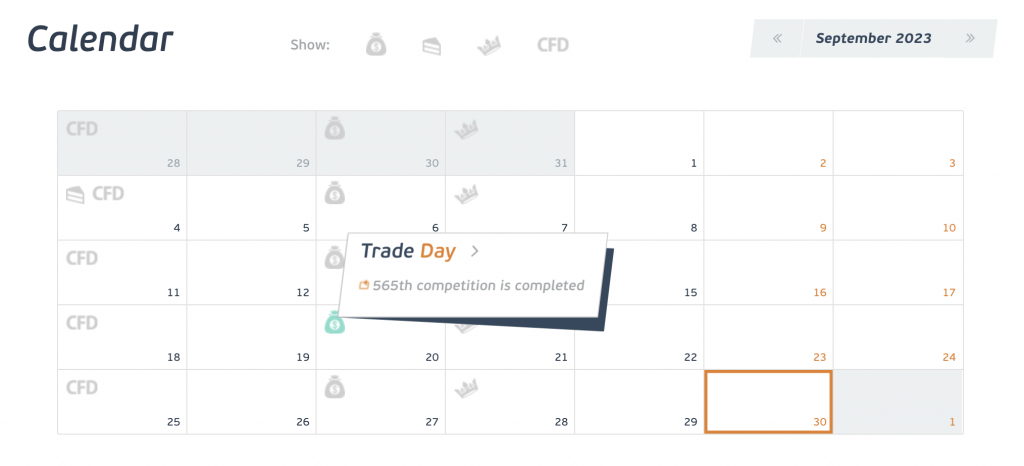

A wide variety of demo trading contests are available

We found that RoboForex offers a choice of daily, weekly, or monthly contests, providing plenty of opportunities for aspiring traders.

Moreover, there are competitions with different goals, trading platforms and asset classes, and all operate on an ongoing basis.

Our tip is to make use of RoboForex’s contest calendar, which highlights start and end dates and makes it simple for traders to plan their entrance to upcoming tournaments.

A good place to practice trading with high leverage

RoboForex offers very high leverage up to 1:2000 on forex.

While we do not generally recommend high leverage to beginners, if this is what traders want, then the broker’s demo competitions are a good place to test strategies before risking funds and potentially large losses.

Cons

No cash prizes or negative balance protection

Similar to LiteFinance, we cannot withdraw prize funds. Instead, rewards are paid into live trading accounts.

We also found issues with the trading terms. The broker does not offer negative balance protection while using trading credit in real-money mode, so we could lose more than our balance. In addition, we learned that if contest rewards are used alongside deposited funds, capital will be used to offset any losses first.

As a result, our tip is to use stop-loss orders to limit exposure. These are available in the broker’s trading platforms.

Extensive ‘TimeOut’ restrictions

RoboForex imposes some lengthy ‘TimeOut’ restrictions for contest winners. This includes a 24-contest ban for the champion of Trade Day and a 12-contest ban for the winner of a KingSize MT5 competition.

While we think there is value in imposing restrictions that prevent the same skilled traders from winning every competition, we think the length of these restrictions is excessive.

Why Is RoboForex Better Than The Competition?

RoboForex stands out for its regular and continuous forex demo competitions. The choice of participating in a daily, weekly, or monthly contest on different platforms is appealing to a wide range of traders.

We struggled to find a forex broker that offers such high leverage up to 1:2000 in its demo trading environment.

Who Should Choose RoboForex?

RoboForex’s demo competitions are good for investors looking to practice trading with high leverage.

They are also suitable for traders that want to regularly join demo contests, with tournaments every day.

Who Should Avoid RoboForex?

Traders who want to win real cash in demo trading competitions should not sign up with RoboForex. The only prizes available are trading credits for use under live trading conditions.

Additionally, traders who don’t have the risk appetite for highly leveraged trading will be better off with a good, regulated broker like FXCM.

CloseOption: Best For Forex Binary Options

| Regulated: | |

|---|---|

| Demo account: | |

| Copy Trading: |

-

💵 CurrenciesUSD

-

🛠 PlatformsProprietary

-

⇔ Spread

GBPUSD: No fee - payouts approx. 80% (Copper) EURUSD: No fee - payouts approx. 80% (Copper) GBPEUR: No fee - payouts approx. 80% (Copper) -

# Assets20+

-

🪙 Minimum Deposit$5

-

🫴 Bonus Offer$10 Welcome Gift

Why We Recommend CloseOption

We recommend CloseOption because it runs weekly binary options contests, which allow forex investors to test their strategies before entering live markets.

The brand offers 24/7 customer support to help beginners get started while 30+ currency pairs are available on the broker’s platform.

Below we uncover why CloseOption is one of our top forex demo competition brokers.

Pros/Cons of CloseOption

Pros

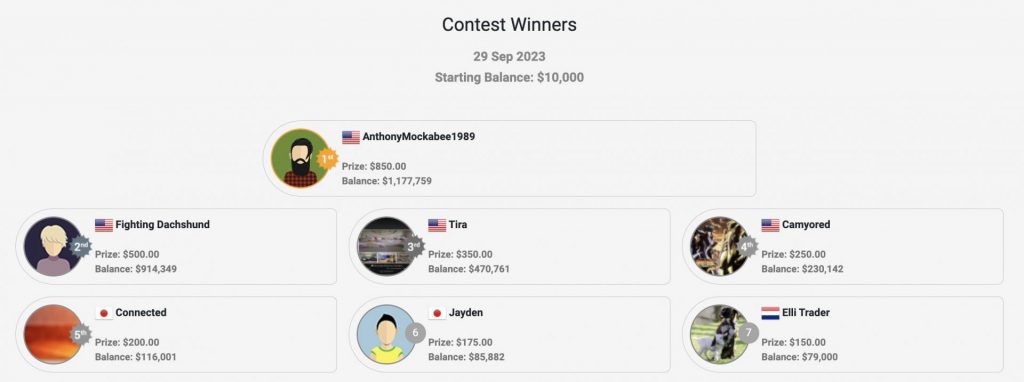

Up to 20 winners each week receive cash prizes

We have reviewed dozens of forex brokers with demo competitions and CloseOption comes near the top for the number of winners it crowns. The top 20 traders each week receive prizes, double that of FXCM.

The prize amounts are also generous, with the top performer receiving $850 while incrementally smaller amounts are paid out to the other 19.

Demo contests can help teach the basics of forex binary options

CloseOption’s demo contests provide an excellent environment to learn how forex binary options work. New investors can learn how to use these derivatives in a risk-free setting.

Essentially, traders predict whether the price of a currency pair will rise or fall over a chosen timeframe. Correct predictions lead to a payout, often displayed as a percentage, while incorrect predictions will see the loss of the stake.

Beginner-friendly competition terms with restrictions on subsequent entries

Winners of the weekly demo contest are unable to participate in the following two competitions, which means that new traders have a better chance of winning.

Though this is not inclusive of skilled traders, we feel this suspension period makes the competitions more friendly to new forex investors.

Cons

Participation fees up to $10

A large number of CloseOption demo contests have a $5 to $10 participation fee. We see this as a big disadvantage, particularly as the competition winners in 20th place are eligible for a prize of just $25.

In comparison, brands such as FXCM run most of their forex demo trading competitions at no charge.

CloseOption is not overseen by a reputable regulator

CloseOption is registered in the country of Georgia and is not overseen by any trusted regulators, which raises the risk factor.

With that said, this is typical of forex binary options brokers, which have been frozen out by regulatory restrictions in many major jurisdictions.

Why Is CloseOption Better Than The Competition?

CloseOption runs demo trading competitions weekly. This is more than nearly every other forex broker we assessed. This makes the firm a good option for frequent opportunities to test skills.

CloseOption also crowns more winners and hands out more prizes than most forex brokers with demo trading contests, with 20 top traders each week.

Who Should Choose CloseOption?

The CloseOption demo contests are ideal for beginners interested in trying forex binary options. The challenges are available on the broker’s user-friendly platform and have fair conditions for investors new to this straightforward but less common style of speculating on the foreign exchange market.

CloseOption is also good for regular opportunities to refine trading skills and compete against other investors. We can always join the weekly demo contest as long as we haven’t won in the previous two weeks.

Who Should Avoid CloseOption?

Forex traders looking for a heavily regulated forex broker should avoid CloseOption. It is based offshore with limited trader safeguards. If top-tier regulation is a must, you should consider a different forex broker on our list, such as FXCM.

Investors looking for traditional ways to speculate on currency markets, such as contracts for difference (CFDs), should also steer clear of CloseOption. It only offers forex binary options.

What To Look For In Forex Brokers With Demo Competitions

To find the best forex brokers offering demo trading contests, we tested and compared firms in several areas:

The Frequency Of Demo Trading Competitions

Our findings show that the top forex brokers with demo competitions regularly run tournaments for traders to participate in, with some even offering daily or weekly events.

Ultimately, the more regularly competitions are available, the more opportunities we have to test our skills against other investors.

The Fairness Of Contest Terms And Conditions

Whilst some forex demo competitions advertise enticing prizes and large rewards, these promises can be misleading, especially at unregulated firms.

With this in mind, we carefully review competition rules to make sure traders will be treated fairly. We found out exactly how prizes are awarded and whether they are attainable.

Even if we do not put any real money at risk, we don’t want to waste our time on misleading marketing campaigns.

The Ease With Which We Can Enter Tournaments

In our experience, the best forex demo competitions are straightforward to enter. We often just need to provide basic contact information to open a demo or contest account. After which we can access the platform to take part.

During our tests, we also checked for any restrictions, such as minimum deposit or volume requirements, previous trading history with the broker, or restrictions on the countries that can take part.

Importantly, the best forex brokers with demo competitions publish all joining requirements and rules so we can read them before taking part.

The Availability Of Prizes For The Winners

Naturally, we want to be rewarded with prizes and perks if we perform well in a demo trading contest. So while comparing forex demo competitions, we looked at the size of prize pools, the number of winning traders, and how many participants typically take part.

We found that the top forex demo trading competitions offer prizes of $1,000 or more per winner. However, the key thing to bear in mind is that some prizes will only be available as free trading credit in a live account. This means they cannot be withdrawn, and if they can, we may need to trade a certain number of lots first.

The Quality Of Forex Trading Conditions

While investors may start in a demo competition, it is important to consider the quality of the forex broker’s trading conditions in the live environment, should anyone choose to start trading with real funds.

This is why we also look at the platforms and tools available. We assess whether they are easy to use with the features we need to analyze the currency markets and place trades.

We also evaluate the spreads and/or commissions to make sure they are competitive. Importantly, we check that there are no hidden fees.

Finally, we look at the live accounts available. Leading forex brokers offer flexible accounts to suit different experience levels and trading strategies.

FAQ

Which Is The Best Forex Broker With Demo Competitions?

The best forex broker that offers demo competitions based on our findings is FXCM. This is a respected brand with excellent trading conditions for online forex traders.

Also on our list of the top brokers for forex demo trading contests are FXOpen, LiteFinance, RoboForex and CloseOption.

Are Forex Demo Trading Competitions Free To Enter?

This will depend on the forex broker and competition. We found that most leading firms do not charge an entrance fee, though some platforms charge between $0 and $10.

Can I Win Real Money In Forex Demo Competitions?

Some forex brokers running demo trading competitions offer real cash prizes.

However, it is important to check the contest rules as there may be restrictions, such as the funds only being available for real trading or the need to trade a certain amount before requesting a withdrawal.

Article Sources

FXOpen – Forex Demo Competitions

FXCM – Forex Demo Competitions

LiteFinance – Forex Demo Competitions