FXTM

-

💵 CurrenciesUSD, EUR, GBP, PLN, CZK, NGN

-

🛠 PlatformsMT4, AutoChartist

-

⇔ Spread

GBPUSD: 0.3 (var) EURUSD: 0.1 (var) GBPEUR: 0.2 (var) -

# Assets50+

-

🪙 Minimum Deposit$50

-

🫴 Bonus Offer30% up to $100 via Exinity Ltd

Our Opinion On FXTM

FXTM is a multi-regulated forex broker with over four million traders. Standout features based on our assessment are the ECN trading conditions with tight spreads from 0.0 pips and low commissions of $2. The fast execution speeds and reliable MetaTrader 4 platform will also serve active forex traders. Additionally, FXTM is fairly unique with its forex indices, which offer exposure to a basket of popular currencies.

Considering the negatives, we found that spreads in the standard account trail the cheapest forex brokers. FXTM also offers a slim product portfolio compared to alternatives we test, with limited opportunities beyond forex.

Summary

- Instruments: 400+ including 55 forex pairs, stocks, indices commodities, cryptos

- Live Accounts: Micro, Advantage, Advantage Plus, Pro

- Platforms & Apps: MetaTrader 4

- Deposit Options: Bank cards, wire transfers, Skrill, Neteller

- Demo Account: Yes

Pros & Cons

- Very low fees on the ECN account with spreads from 0 pips and $2 commission

- Trusted forex broker regulated by the FCA and CySEC

- Excellent range of 55+ currency pairs plus forex indices

- Access to MetaTrader 4 on desktop, web and mobile

- Islamic trading conditions available on all accounts

- Ultra-fast execution speeds averaging 17 ms

- 24/5 customer support in 30+ languages

- Forex VPS hosting for algo traders

- FXTM Invest copy trading service

- Average spreads on the Micro account during our tests

- Withdrawal fees on some methods including €30 for wire transfer

- Offshore entity operates with limited regulatory oversight

- Narrow range of investments beyond forex

Is FXTM Regulated?

FXTM is authorized by some of the most respected regulators, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities & Exchange Commission (CySEC).

This oversight means that FXTM follows the safeguarding measures that we consider crucial, including keeping clients’ funds in segregated bank accounts to prevent misuse. FXTM also provides negative balance protection, ensuring traders cannot lose more than their account balance when trading with leverage.

Ultimately, we have no concerns regarding the legitimacy and credibility of this forex broker. The only thing worth calling out is that traders who sign up with the offshore entity will receive less regulatory protection.

Forex Accounts

FXTM offers three retail trading accounts: Micro, Advantage and Advantage Plus.

The Micro account is best for beginners, with a low starting deposit of $50, commission-free trading and a minimum volume of 0.01 lots. On the downside, the Micro account does not offer trading on commodities and indices.

The Advantage and Advantage Plus accounts will serve experienced traders, with no limit on the number of open orders or limit and stop levels. These accounts require a larger initial investment of $500.

Below is a comparison of the accounts to help you find the right solution for your trading style.

| Micro | Advantage | Advantage Plus | |

|---|---|---|---|

| Minimum Deposit | 50 | 500 | 500 |

| Account Currency | USD / EUR / GBP | USD / EUR / GBP | USD / EUR / GBP |

| Investment Offering | Forex, Metals | Forex, Metals, Indices, Commodities | Forex, Metals, Indices, Commodities |

| Spreads | From 1.5 | From 0.0 | From 1.5 |

| Commission | $0 | Average $0.40 – $2 | $0 |

| Order Execution | Instant Execution | Market Execution | Market Execution |

| Limit & Stop Levels | 1 Spread | No | No |

| Maximum Number of Open Orders | 300 | Unlimited | Unlimited |

| Maximum Volume Per Order | 10 | 100 | 100 |

| Maximum Number of Pending Orders | 100 | 300 | 300 |

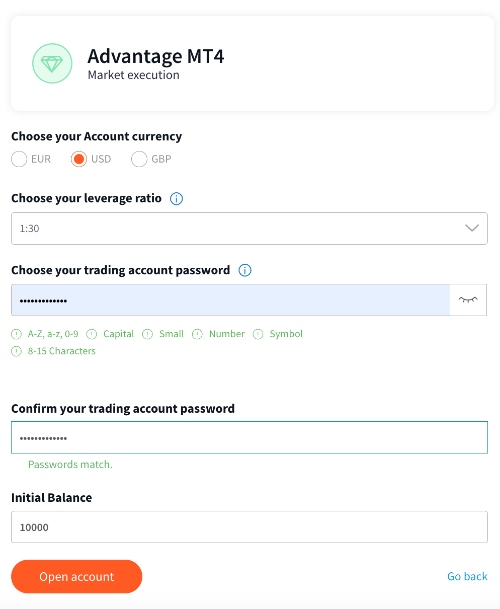

How To Open An Account

Opening an account with FXTM only took me a few minutes thanks to the slick sign-up process. Register by following these steps:

- Provide your name, email and phone number in the sign-up form

- Verify your account using the pin sent to your email/phone number

- Choose your account type (Micro, Advantage, Advantage Plus)

- Provide personal details and information about your financial background and source of funds

- Upload ID and proof of address

- Make a deposit to fund your account

Trading Fees

Commission-free trading is available in the Micro and Advantage Plus accounts, with the broker taking its cut through spreads. Importantly, spreads are floating and will vary depending on market conditions and currency pairs.

During testing, typical spreads were fairly competitive though not the cheapest we have seen. The 1.3 –1.5-pip minimum matches most forex brokers we review, but does not compete with our top-rated sub-1-pip commission-free forex brokers, such as CMC Markets.

On the other hand, spreads on the ECN Advantage account are up there with the best, starting from around 0.1 pips. We also rate the $2 per lot commission, which is among the lowest out there.

Non-Trading Fees

We give FXTM an average score when it comes to non-trading fees.

Traders will pay industry-standard swap fees if they hold positions overnight. There is also a $5 monthly inactivity fee, though we are glad to see that this does not kick in until 12 months of zero trading activity.

However, my main complaint is the withdrawal fee. There is a €30 charge if I want to withdraw by bank transfer and a €2 charge if I use Visa or Mastercard. Fortunately, I can withdraw for free if I opt for Skrill or Neteller.

Payment Methods

Although FXTM accepts some e-wallets as well as traditional payment methods, we feel the range is slightly disappointing, considering the lack of popular solutions like PayPal and Apple Pay.

On a lighter note, deposits are free and processed instantly with e-wallets or within 2 hours for bank cards and 1 business day for wire transfers. I have no issues funding my account via debit card and find this a very fast and convenient solution.

Withdrawals are also quicker than many alternatives in our experience. Cards and e-wallets offer same-day processing while wire transfers are slower, taking up to 5 working days.

How To Make A Deposit

Depositing with FXTM is a quick and easy process that involves only a few steps:

- Log in to the MyFXTM client portal

- Select ‘Deposit’ and choose your preferred payment method

- Enter the deposit amount ($50 minimum)

- Provide any additional details requested

- Confirm the transaction and check your balance

To prevent any delays, make sure you have verified your account and submitted the requested documentation before you fund your account.

Forex Assets

FXTM provides access to over 55 major, minor and exotic currency pairs. This is a good range of forex CFDs that beats many competitors and provides opportunities for beginners and serious traders alike.

We also rate the selection of forex indices (USD, EUR, GBP, JPY, AUD, NDZ). These offer broader exposure to popular currencies by measuring their performance against a group of relevant currencies. These are relatively unique products that we don’t see at many competitors.

| Forex Pair | Available | Forex Pair | Available |

|---|---|---|---|

| EUR/USD | Yes | AUD/USD | Yes |

| GBP/USD | Yes | USD/JPY | Yes |

| EUR/GBP | Yes | USD/CHF | Yes |

| USD/CAD | Yes | EUR/AUD | Yes |

| NZD/USD | Yes | AUD/NZD | Yes |

Non-Forex Assets

The narrow range of additional instruments is a noticeable drawback in our book. With a handful of commodities and indices, plus just 300 US and European stocks, FXTM doesn’t match rivals who offer thousands of instruments, including IG Group.

This may not deter serious forex traders, but investors looking for diversification opportunities will be disappointed. The Micro account is particularly limiting, with just forex and metals.

Execution

FXTM provides a choice of execution modes. The electronic communication network (ECN) accounts offer market execution with very tight spreads and impressive execution speeds averaging 17 milliseconds during our review – much lower than most forex brokers we evaluate. This makes FXTM a great option for active forex traders and scalpers.

The non-ECN accounts use instant execution. This is arguably less attractive – the broker takes the other side of trades and you may see requotes if the price isn’t available.

Leverage

Leverage at FXTM varies depending on the jurisdiction. FXTM’s EU and UK branches do not offer leverage beyond 1:30 on forex. In contrast, the offshore branch offers very high leverage up to 1:2000, which is among the highest available from any broker on the market.

Importantly, we urge beginners to stick to lower limits. High leverage is more of an advantage for experienced traders who practice very tight risk management.

Platforms & Apps

A key advantage of trading forex at FXTM is access to the MetaTrader 4 (MT4) platform, available as a desktop client, web trader, or mobile app on Apple and Android devices.

It is hard to beat when it comes to charting, with interactive, customizable graphs that allow me to track the markets live. I also appreciate the 30 integrated technical indicators that help with finding patterns and identifying entry and exit points, plus the 9 timeframes and 3 types of charts.

The other bonus for me is its support for automated forex trading. The software has been designed with algo traders in mind, so you can build and test expert advisors and scripts directly through the terminal. Alternatively, the MetaTrader Market is home to thousands of EAs that you can download for free or pay for.

Overall, I think MT4 will meet the needs of beginners and active forex traders.

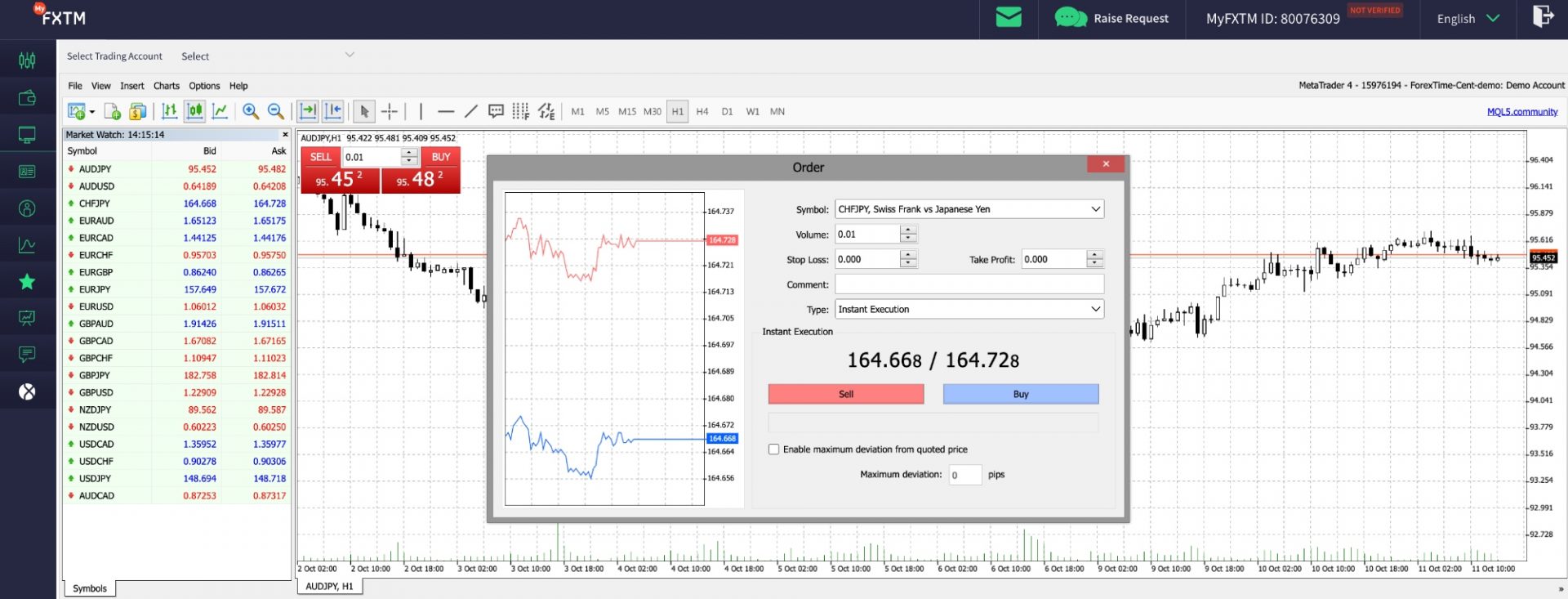

How To Make A Forex Trade

Trading forex with FXTM is an enjoyable process thanks to the intuitive MetaTrader platform. To get started:

- Sign in to the MT4 desktop, web or mobile platform

- Search for and select the currency pair you want to trade

- Select order type – market, limit, stop, etc

- Enter the volume in lots

- Set stop loss and take profit orders (optional)

- Click ‘Sell’ or ‘Buy’ to place the order

Alternatively, you can trade forex directly from charts with one-click trading. This can be enabled from the menu at the top of the platform interface.

Forex Tools

I have been impressed with the wide range of forex trading tools available, which include copy trading for aspiring investors and virtual private server (VPS) hosting for hands-on traders.

I think the pip and profit calculators are especially useful for beginners. They are free to use and can help you plan trades and check the potential gains outweigh the risks before making a trade.

FXTM Invest

We tried out the broker’s copy trading platform, FXTM Invest, and it allowed us to mirror the strategies of top investors automatically. The brokerage has over 800 strategies with verified track records to choose from, which we consider an impressive selection.

Overall, we think the platform is easy to use with clear performance metrics to help you find traders to follow. However, for us, it doesn’t match the best-in-class social trading app available at eToro.

VPS

We see VPS access as a big advantage since it provides low-latency, reliable connectivity for active forex traders. So, we are pleased to find that FXTM supports this feature.

Trading through FXTM’s VPS offers a 99.9% operational connection time and 24/7 access to the financial markets. It also integrates seamlessly with the MT4 platform and expert advisors.

To access a VPS from FXTM, contact your account manager.

Forex Research

FXTM provides market news and analysis from in-house experts and third-party providers, creating a reliable base of resources for forex trading. There is also a daily video overview, fundamental analysis, technical outlook, economic calendar and more.

Based on our experience, these research tools provide good coverage of the latest market moves, macro overviews, analyst opinions and more. Overall, we found the quality and scope of research tools to be comprehensive.

Forex Education

We have been impressed with the range of educational resources in the Knowledge Hub. These include e-books and guides, video tutorials, webinars, seminars, and a glossary.

Our team finds that the educational content does well covering forex basics, technical/fundamental analysis, risk management, trading psychology and strategy, providing an ideal starting point for new traders looking to develop their skills.

There are also special courses for beginners to get started with forex and short videos on the FXTM YouTube channel.

Our only minor criticism is that the training materials are more limited for experienced traders, so we would like to see the broker expand their offering on this front in the future.

Demo Account

FXTM provides a free demo account. We recommend starting here if you are new to the MetaTrader 4 platform. It offers $100,000 in virtual funds, real-time market prices, and the ability to test strategies risk-free.

We especially rate that FXTM demo accounts do not expire, making them a useful tool for retail forex investors.

How To Open A Demo Account

I found setting up an FXTM demo account a very quick and easy process that involved a few simple steps:

- Go to FXTM and click ‘Open Demo Account’

- Enter your contact details and email

- Verify your email address using the code

- Login credentials will be emailed to you

- Download MT4 and enter your demo login details

Bonus Offers

The forex broker runs occasional promotions with bonuses on deposits or cash rebates based on trading volumes.

While using FXTM, we were offered a 30% welcome bonus up to $300, as well as a refer-a-friend bonus up to $10,000. We recommend traders check the website for the latest bonus offers. Also note that we found rewards often come with a trading volume requirement before withdrawals are permitted.

It is also worth being aware that bonuses are not available in heavily regulated jurisdictions like the EU, UK and Australia.

Trading Restrictions

We are pleased to see that FXTM allows all trading strategies including scalping, hedging and the use of expert advisors. We experienced no strategy limitations during testing.

Customer Service

FXTM provides customer support that we feel is among the best around, with 24/5 coverage, fast response times and multilingual support.

You can contact FXTM via live chat, telephone, email, contact form, Viber and Telegram. Support is available in over 30 languages including English, Chinese, Indonesian, Vietnamese, and Thai.

Importantly, we see fast response times in live chats and phone calls with knowledgeable representatives who can support account and platform queries.

Company Details

ForexTime, better known as FXTM, was founded in 2011 and is one of the leading brokers in online forex trading. This is evidenced by its over 4 million registered users and more than 30 industry awards.

To serve its global client base, the brokerage has over 800 employees in more than 10 countries, including London, Cyprus and Mauritius.

Overall, we are satisfied that FXTM is a legitimate forex broker with a good reputation.

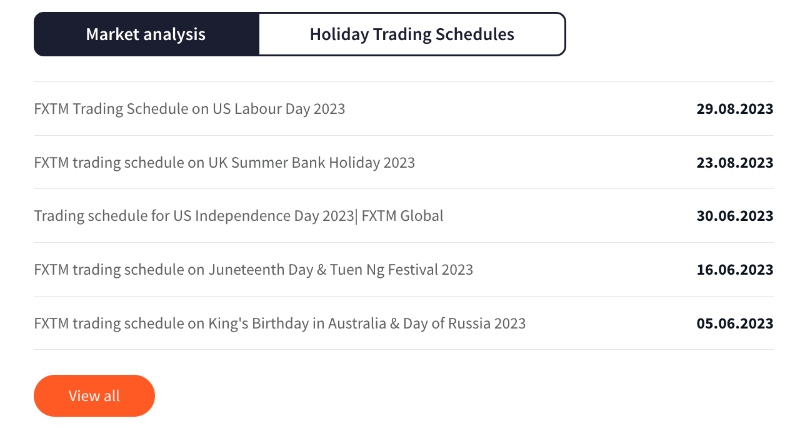

Trading Hours

Trading hours run from Sunday 17:05 ET until Friday 16:55 ET. There is a break each day from 21:55 ET until 22:05 ET.

Importantly, in our experience, details of any scheduled maintenance or holidays closing the markets are clearly listed on the broker’s website.

Who Is FXTM Best For?

Based on our tests, we highly recommend FXTM for a range of new and experienced traders, but especially:

- Active forex traders, scalpers and high-volume investors seeking ultra-tight spreads with fast execution speeds

- Forex investors and algo traders looking to use powerful platforms like MetaTrader 4 with expert advisors and VPS hosting

- Casual investors seeking copy-trading services to mimic strategies

FAQ

Is FXTM Legit Or A Scam?

Our research shows that FXTM is a legitimate broker regulated by trusted financial agencies They have a long track record, having been running since 2011, and we found no evidence of scams.

Can I Trust FXTM?

FXTM is a trustworthy forex broker based on our assessment. It is heavily regulated, won dozens of awards, has a good reputation, and offers important safeguards, including segregated accounts and negative balance protection.

Is FXTM A Regulated Forex Broker?

Yes, FXTM is regulated by several financial bodies, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities & Exchange Commission (CySEC). These are both well-regarded regulators.

Is FXTM A Good Or Bad Forex Broker?

FXTM is a good all-round forex broker. Looking at the positives, over 55 major, minor and exotic pairs are available, as well as 6 currency indices you can’t find at most alternatives. Fees are very low, especially on the ECN account, while execution speeds are fast and the market-leading MetaTrader 4 platform is available.

Looking at the negatives, spreads on the Micro account are reasonable but not the lowest we have seen. There are also withdrawal fees for cards and bank transfers. The product portfolio beyond forex is also much smaller than many alternatives.

Is FXTM Good For Beginners?

Yes, FXTM is good for new forex traders. The $50 minimum deposit is low, the educational materials are excellent and there is a copy trading service where you can follow more experienced investors.

Does FXTM Offer Low Forex Trading Fees?

Yes, FXTM offers very low fees, especially on its ECN account, where spreads start from 0 pips with a $2 commission – much lower than most forex brokers we have reviewed.

Does FXTM Have A Forex App?

Clients of FXTM can trade forex on the MetaTrader 4 app. It is available on Apple and Android mobile and tablet devices and offers seamless integration from the desktop platform.

How Long Do Withdrawals Take At FXTM?

Withdrawals are processed within 24 hours but can take 2–5 days to reach your account based on our experience at FXTM. This is on the faster side of most forex brokers we evaluate, with e-wallets offering the quickest withdrawal times.

Can You Make Money Trading Forex With FXTM?

FXTM offers a competitive trading environment where some investors will make money. Traders get powerful tools, reliable order execution and low fees.

However, your capital is always at risk when trading forex online. So, make sure you only risk what you can afford and make the most of risk management tools like stop-loss orders to cap losses.